I attended two days at SAP’s SapphireNOW conference in Madrid earlier this month, at the end of a month-long trip to Spain and Italy. The trip to Madrid gave me a good opportunity to catch up with the latest developments with SAP since the Sapphire conference last May in Orlando.

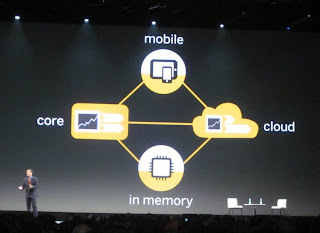

I attended two days at SAP’s SapphireNOW conference in Madrid earlier this month, at the end of a month-long trip to Spain and Italy. The trip to Madrid gave me a good opportunity to catch up with the latest developments with SAP since the Sapphire conference last May in Orlando.Jim Hagemann Snabe gave the Wednesday keynote, which I found tighter and more balanced than similar messages delivered in Orlando. Back then, the keynotes seemed to overly emphasis HANA, SAP’s new in-memory database technology. Although HANA is still hugely important to SAP, the message is now more balanced between SAP’s three focus areas of innovation: mobile, cloud, and in-memory computing.

I also appreciated Snabe's tone, focusing positively on SAP’s roadmap and customer success stories. This was a welcome change from recent keynotes by the CEOs of some of SAP’s competitors, whose bar-room brawling style might be more entertaining but doesn’t provide much real insight. Personally, I find Snabe’s low-key approach much more palatable, and I have to believe customers feel this way also.

So, in a nutshell, here is my bottom line: I see SAP in a period of transition with cloud computing, mobility applications, and in-memory computing. There is progress, but success is not ensured.

Business ByDesign Has Momentum, but Line of Business Apps Lagging

SAP has two major cloud initiatives: its Business ByDesign (ByD) ERP suite for small businesses and its Line of Business (LoB) SaaS applications, which complement its Business Suite.Concerning ByD, SAP is on target to reach 1,000 customers sold by year end, although SAP executives indicate that reaching that goal might come down to the wire. Although reaching or exceeding that number will matter to some SAP folks’ year-end bonuses, I would view anything close as being a significant accomplishment. My consulting team at Strativa recently evaluated ByD in a competitive deal and came away favorably impressed. Customer reference checks during the Madrid conference were also encouraging. I believe SAP has a winner with ByD: both for subsidiaries of its large customers and in net-new small business deals. Those who question the viability of ByD at this point should reconsider their assumptions.

On the Line-of-Business side, progress is not as impressive. SAP has one SaaS application—Sales On Demand—in general release. But don’t expect to see other applications any time soon. Travel On-Demand (mostly expense reporting) will go into beta in Q1, 2012, according to Sven Denecken and Kevin Nix, who head up LoB development. Career On-Demand is scheduled to go to the first beta customer in Q2, 2012. In addition, Kevin and Sven told me of another LoB application now in development: Social Service and Marketing On-Demand. I have no target date for this product.

SAP positions these LoB applications as people-centric applications, helping end-users accomplish their daily activities. Although this is an interesting approach, the LoB apps do not have very broad functional footprints. For example, Sales On-Demand is primarily focused on the collaboration of pre-sales teams and others as they coordinate their activities for specific prospects. It is by no means a complete CRM package—it is not even a complete sales force automation app. Likewise, Career On-Demand is not a complete talent management system. Rather it is focused on helping people manage their goals, objectives, and daily activities and to see what others across the organization are working on. Finally, Social Service and Marketing is narrowly focused on processing incidents originating from Twitter and other social media channels.

In my view, the LoB applications are a defensive play by SAP, aimed at keeping its installed base from leaving the SAP-fold for newer cloud-based providers. For example, in my view, Sales On-Demand is aimed at keeping SAP CRM customers from considering Salesforce.com. Likewise, Career On-Demand is meant to keep SAP HRMS customers from considering Workday. Finally, Travel On-Demand is SAP’s answer to Concur’s expense management system. SAP may be successful in getting its installed base to adopt some of these LoB applications, but because they are not complete solutions, I do not think they are an adequate response to the threat from Salesforce.com, Workday, Concur, and others. Furthermore, it is hard to imagine non-SAP customers purchasing these solutions.

The other problem with the LoB applications, frankly, is that they are a late response by SAP. Salesforce.com, Workday, and Concur have been developing and marketing their applications for years. In the case of Salesforce.com, over 10 years, and SAP is only now starting to respond? It’s like the student who turns in (hopefully) a well-written essay, but misses the deadline.

So, on my scorecard, SAP gets an “A” for ByDesign and a “C” for its line of business applications.

Turning the Ship on Mobile Applications

On the mobility front, SAP appears to be making good progress. Based on a briefing I received, there are now 50 mobility apps available in the new SAP Store. Of these 38 are authored by SAP and 12 are from partners. There are 200 more in the development pipeline (split between SAP and partners is not clear to me).All of the current apps in development are based on the Sybase Unwired Platform (SUP), and this is where there are some issues. The SUP is a general platform for mobility device development and management. It allows a developer to write an application and have it deployed on multiple devices, such as RIM’s Blackberry, Apple’s iPhone/iPad, Android devices, and Windows phones. It also provides an enterprise-class management platform for back-end data access, application provisioning, user and device management, and security. So from the perspective of ensuring that its mobility apps are enterprise-class, I can understand why SAP would want mobile applications developed by partners to be certified for SUP.

The problem, however, comes from the developer perspective. Many of the best mobile apps development these days are coming from small shops, and current SAP licensing practices by SUP are, shall we say, burdensome for small developers. Based on briefings we received, it appears SAP understands the obstacles in the way of small developers and wants to show some flexibility on this issue. There is talk of allowing developers to work outside of SUP and then submitting their applications for certification. There was even talk at some point of allowing apps to be sold via the SAP Store that do not run on top of SUP, but that is by no means current policy.

My colleague Dennis Howlett has a deeper dive on SAP's mobility progress.

So, it would appear that on the mobility front, SAP is in transition. They are making good progress, but they need to follow through on their good intentions to become more developer- and partner-friendly in mobile apps development.

In-Memory Computing Still Rings SAP's Bell

Although the Madrid messaging was balanced among the three areas of innovation, you can still sense the excitement among SAP executives when they come to the subject of in-memory computing. They honestly feel that its in-memory technology (HANA) will leap-frog SAP over its competition. In a small group briefing with Vishal Sikka, he spent significant time talking about the value proposition of in-memory computing to provide faster answers to business queries, without the constraints of data structures such as cubes. The value of HANA has already been demonstrated in a limited number of one-off proof of concept projects for select customers, many of whom were featured in the Orlando conference.The next step is to scale up HANA adoption by using it as a customer platform for SAP’s business warehouse (BW) deployments. In a sidebar conversation with Sanjay Poonen, SAP’s President of Global Solutions, he indicated this is where most SAP customers will first realize the value of HANA.

Ultimately, though, SAP intends to bring in HANA underneath parts of the Business Suite—we had one briefing from a customer looking to run HANA underneath its trade promotion processing to more quickly analyze pricing trends. SAP has a far-reaching vision for HANA to ultimately become the data platform for many of its products.

So SAP is also in transition with in-memory computing: moving it from a small number of proof-of-concept case studies to a broader adoption by its customer base. This migration has only just begun.

Can SAP Make The Needed Transitions?

For the largest enterprise software vendor in the world, the roadmap is good. But is it possible for SAP to complete the needed transitions? There are strong economic rewards up front for HANA, which are big ticket license sales. But will SAP be willing to devote the resources necessary for its cloud solutions and mobility applications to be successful, where the deals are smaller? The signs are encouraging, but success is not ensured.- Progress is good with mobility apps, but the partner model needs to be improved. When small mobile developer partners, like Graham Robinson, tell me they are happy with SAP’s support then I will be convinced that SAP stands a good chance of being successful. The words coming from SAP executives are the right sounds, but I’m waiting to hear confirmation from small developers that SAP’s actions are following its words.

- It is going to be interesting to see how SAP’s cloud computing programs proceed. For SAP, cloud is both a sustaining innovation and a disruptive innovation (to use the terminology of Clayton Christensen). From the standpoint of SAP’s large customers with many small subsidiaries, ByD is a sustaining innovation because it gives them something to offer for their subsidiaries. Many competitors, such as Microsoft Dynamics, Epicor, NetSuite, and Plex, are targeting these subsidiaries in a so-called "two-tier ERP" strategy. Thus, ByD preserves and extends the revenues that SAP receives from these large customers.

The larger question is whether ByD can consistently beat out cloud-based competitors such as NetSuite, Plex, or Rootstock for net new deals in small organizations. As I indicated, the signs so far are good. But will SAP be willing to invest what it takes for such small deals? Furthermore, will SAP be willing to let ByD naturally grow up-market and start to disrupt (cannibalize) its sales of SAP All-in-One or even its Business Suite? If so, then I would declare victory for ByD as a truly disruptive innovation.

I do not view SAP’s LoB applications as disruptive. These apps are targeted primarily at SAP’s installed base and are therefore a sustaining innovation for SAP. They do not need to be best-in-class. They only need to be good enough to keep customers from going with SFDC, Workday, Concur, or other pure best-of-breed cloud solutions. But, as noted earlier, these are not complete solutions and may not be enough to keep SAP customers from looking elsewhere. Also, they are unlikely to find much of an audience outside of SAP’s installed base. - Although I would agree generally with Vishal’s assessment about HANA, from an economic standpoint, in-memory computing does not require SAP to transition its thinking or business model. From an economic standpoint, in-memory computing is a sustaining innovation for SAP. SAP can use in-memory computing to continue to sell big-ticket licenses to big-ticket customers and receive large annuities in the form of maintenance fees. It is not like cloud and mobile which require that SAP make changes in its expectations on how it will make money in the future.

I made some of the same points in a very short interview with Dennis Howlett, during the Madrid conference. You can watch the interview below.

Postscript: I’ll repeat here what I said to my SAP host when I bid goodbye from the Madrid conference: I know some of us often give SAP a hard time. But we do it for one reason: we care about SAP’s customers, just as SAP does, and we want SAP to be successful for their sake.

Disclosure: SAP paid part of my travel expenses to attend the Madrid conference.

10 comments:

If the industry moves to a pure cloud ecosystem, how might the technology under HANA be used?

In other words, does HANA lend itself to a multi tenant model?

Matthew, my understanding is that HANA already sits under Business ByDesign, so the answer is yes.

Thanks Frank.

Does this mean that BusinessByDesign offers vastly superior query/commit performance over other multi-tenant players (that don't used in-memory applicances such as Oracle Exadata)?

I am having trouble locating my briefing notes regarding HANA underlying ByD. But I do believe SAP would represent that HANA does allow ByD to offer superior data analysis capabilities. If you think about it, it's interesting that all the tenants in a multi-tenant ByD instance are able to have all their data sitting in main memory.

Right now, Business ByDesign's analytics are in-memory but it isn't HANA per se, but TREX, SAP's in-memory column store that was one of the building blocks/precursors to HANA.

SAP does have plans to put all of ByD on HANA as I understand it. However, last time I talked with the SME leadership at SAP about this, the first SME product to run on HANA was slated to by Business One, which has already been done in lab settings.

As for the question from Matthew King of whether ByD in-memory gives SAP an advantage against other SaaS products, I'm not sure I would say it does, for two reasons: first, Workday, one of SAP's main SaaS competitors looking ahead, is built entirely on in-memory already.

Second, SaaS performance is not just about in-memory but also network speed/bandwidth, and the speed of the resident data servers where the systems are hosted.

I know SAP is approaching ByD performance from all directions and not just in-memory. Having said that, I do think all major SAP products, including ByDesign, will run on in-memory in the next few years, likely it will run on HANA specifically. That will be some source of competitive advantage for SAP in some situations, but other vendors are not standing still either.

- Jon

Jon, thanks for the more complete and more accurate explanation. Much better.

Thanks Jon. That helps - and is interesting.

Right now I'm thinking - if SAP "HANA enables" ECC - will SAP customer have a choice of database applicance?

I also wonder if anything is stopping SAP customers from running ECC over an Oracle Exadata applicance today - apart from cost.

The LoB applications are directed at the individual employee. That is effective software for both large and small organisations, where there's significant decentralization/diffusion of resourcing and production.

Hi,

FYI the link to the developer comments of Graham Robinson have been removed.

Can you tell us what they were?

Thanks

Padmanabha, I see that the link behind the anchor text "Graham Robinson" is dead. I believe the SCN site is undergoing a migration, and I'm hoping that link will be restored shortly. Otherwise, I cannot even locate his post.

Post a Comment