When it comes to enterprise IT decisions, I have come to the conclusion that buyers shouldn’t read the financial press. There are industry analysts and there are financial analysts, and they address two distinct audiences.

When it comes to enterprise IT decisions, I have come to the conclusion that buyers shouldn’t read the financial press. There are industry analysts and there are financial analysts, and they address two distinct audiences.Exhibit A is this Business Insider post, entitled, The Awful Economy Is Really Going To Hurt SAP. Here’s the post’s lede:

SAP's hot new software, HANA, has been a relative flop, said BofA Analyst Chandra Sriraman this morning.The post goes on to quote Sriramen concerning why he feels that SAP “will be hurt by slower demand from its key manufacturing customers, depressed business confidence and the financial mess in Europe.”

HANA was hailed as groundbreaking when it was introduced about a year ago. It sits in a computer's memory so it literally runs while the computer processes transactions.

There's just one problem: No one is buying it.

Now, what are prospective buyer of SAP’s software supposed to make of this commentary? That the prospect should not move forward? If I am an SAP customer, should I be concerned?

The answer, of course, is no--because financial analysts, like this one, do not have SAP customers or prospects as their audience.

Two Stakeholder Groups

Putting aside the cute part about "HANA…literally [running] while the computer processes transactions" and Sriramen’s conclusion that SAP faces an "awful" 2012 (I happen to think he is wrong), let's understand the difference between a financial analyst and an industry analyst.Every publicly-held enterprise IT vendor (or any publicly held company) has many stakeholders: shareholders (investors), customers, employees, business partners, suppliers, and the community at large. But for purposes of this discussion, let’s focus on the two primary groups of stakeholders: customers and investors. What are the objectives of these two groups?

- Customers are interested in the value of the vendor's product (its benefits and costs), the quality of the vendor's service, the vendor’s ability to innovate, and the long-term viability of the vendor itself.

- Investors, of course, are also interested in these things. But--and this is the key point--investors are not interested in these things directly. They are interested in these things in terms of what they mean for the stock price, short-term and long-term.

But there are also some things that investors are interested in that customers should not at all be concerned about.

- Intrinsic value of the shares. Investors spend a lot of time comparing the intrinsic value of the vendor’s shares (what they should be worth based on fundamentals) versus the current stock price. Stocks that are undervalued by the market tend to rise over the long term.

- Market expectations. Investors—especially short-term investors—spend a lot of time trying to forecast prospective company financial performance for the next reporting period versus management guidance and market expectations. Companies that outperform market expectations will usually see a jump in their stock price.

- Economic outlook. Investors also spend a lot of time refining their outlook for the economy in general or for the industry sector and geographies that the vendor serves, because the vendor’s stock price tends to rise and fall according to these economic outlooks.

Generally, financial analysts do not have the depth of understanding that good industry analysts do, concerning a vendor’s products or customer experiences. They may do reference checks, as best they can, but because they do not deal with customers of the vendor on a day-to-day basis, they lack the direct experience in seeing how the vendor actually performs in the field.

For example, last week, Alan Lepofsky and I provided a short briefing call for a financial analyst from a well-known Wall Street investment firm on the subject of CRM vendors. At the end of the call, the financial analyst remarked that what he liked about our call was our ability to refer to specific examples with specific customers. This is why financial analysts ask for briefings from industry analysts, but seldom do you see the reverse.

Another example: Ray Wang recently gave a short on-camera interview with CNBC on the news that SAP had made a bid for SuccessFactors, an HRM cloud computing provider. Ray deals with enterprise IT sellers every day. But the questions from the CNBC hosts had nothing to do with whether either SAP or SuccessFactors were good choices for buyers. Rather, their only concern was what SAP’s bid for SuccessFactors meant for investors. Here are some examples of the questions they asked Ray:

“What are the big names that pop to your mind here that could be the next ones to [be acquired] in the cloud space?”Now, are these questions that enterprise IT buyers would be asking? I think not.

“What about the pioneer in the SaaS market, valued at $17 billion, Salesforce.com [being acquired]?”

“So, Ray, NetSuite is up nearly 10% today, which is I think an all-time high. Would you rush into this stock right now or is it too much, too fast?”

“Hey Ray, how does this make you feel about SAP here? SAP is a company that for the most part trailed Oracle, it stayed out of the M&A game, it seems very hungry to do deals here—that’s great, it worked for Oracle…but are they getting out of their core competency, are they spending more [for SuccessFactors] than they should here?”

The Right Advisor for the Right Audience

Lest anyone think I am railing against investors--I am not. As a free-market capitalist, I believe that private investment is the best way to pick winners and losers in the marketplace. I trust individuals and organizations putting their own capital at risk more than I trust some government bureaucrat deciding which organization or industry to favor.Furthermore, the best financial analysts often have interesting insights. I do read them from time to time, because they see things from a different perspective (the investor’s perspective). As my late business partner used to say, financial analysts are using “a different algebra.” Seeing things from the investor perspective can help me, as an industry analyst, understand why a vendor may be behaving in a certain way. For example, why a vendor is targeting a certain market segment or de-emphasizing a certain line of business.

But I do believe it is important for enterprise IT buyers to understand that their objectives and success are not always aligned with the immediate interests of investors, and they shouldn't pay too much attention to the short-term stock market performance of an enterprise IT provider.

So, just as shareholders shouldn’t ask me for investment advice, enterprise IT buyers shouldn't read financial analysts for advice on technology decisions.

Update: my friend Jon Appleby has a great post, critiquing the same financial analysis post I referenced here. My friend Vijay Vijayasankar also has a good post on the Bank of America analysis, and has added a comment to my post here.

Related Posts

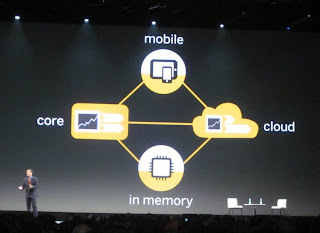

SAP in Transition on Mobile, Cloud, and In-Memory ComputingIT Budgets vs. Tech Industry Spending: What's the Difference?